tucson sales tax rate change

This change has no impact on Arizona use tax assessment which remains at 56. This is the total of state county and city sales tax rates.

State And Local Sales Taxes In 2012 Tax Foundation

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

. The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location. The minimum combined 2022 sales tax rate for Tucson Arizona is. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No.

There is no applicable special tax. That would raise it from 81 percent to 86 percent-. Tumacacori az sales tax rate.

2016 Hyundai Tucson AWD 4dr 20L Premium AWD MAGS from wwwhyundaicertifiedca. Tumacacori AZ Sales Tax Rate. If you do not separately itemize the tax you may factor.

There is no applicable special tax. 19-01 to increase the following tax rates. The 2022 tax lien sale will be online only.

As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. The December 2020 total local sales tax rate was also 11100. The sales tax jurisdiction name is Arizona which may refer to a local government division.

Tumacacori-Carmen AZ Sales Tax Rate. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. To help equip police and firefighters and repair more roads the city wants voters to add a half cent to the sales tax.

The Tucson sales tax rate is. 11518 to authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund. This change has no impact on.

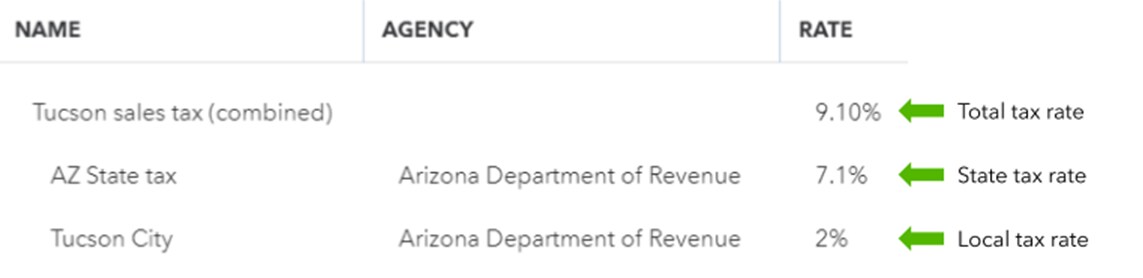

Ad Find Out Sales Tax Rates For Free. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87.

Tucson sales tax rate change Monday February 14 2022 Edit. The current total local sales tax rate in tucson az is 8700. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817.

Tusayan AZ Sales Tax Rate. Effective July 01 2016 the per room per night surcharge will be 4. The Arizona sales tax rate is currently.

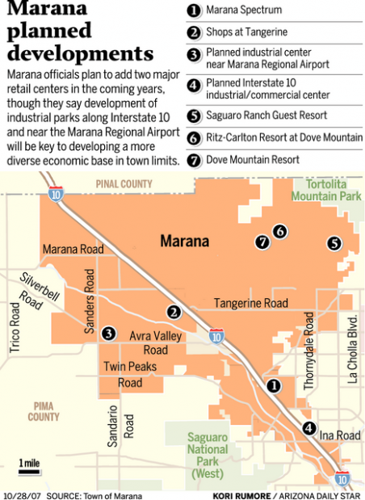

A 1500 refrigerator purchased in Marana where the sales. Tucson AZ Sales Tax Rate. The citys 2 tax rate applies.

See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ. Regardless of when a contract is executed if change orders are executed on or after February 1 2018 they will be subject to the new city tax rate of 26. Fast Easy Tax Solutions.

As of March 1 2018 the local tax rate in Tucson is 26 on the following business classifications. The County sales tax rate is. As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits.

Tucson Estates AZ Sales Tax Rate. Tucson Sales Tax Rate Change. The funds collected over the five-year period would be split with 100 million being used to restore repair and resurface City streets and 150 million would be spent on vehicles equipment and facilities for the Tucson Police Department and Tucson Fire.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725. TUCSON AZ Tucson News Now - Tucson residents have decided that the city will increase its sales tax rate by 12 percent to help pay for road repair and public safety. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53There are a total of 80 local tax jurisdictions across the state collecting an average local tax of 2403.

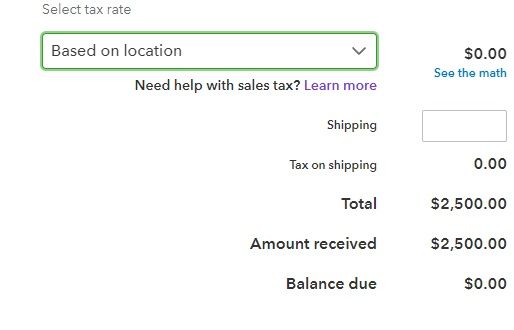

If you itemize tax separately on your customers receipts and keep records of it on your books you may take the actual tax collected as a deduction. The December 2020 total local sales tax rate was also 8700. The current total local sales tax rate in Tucson AZ is 8700.

Arizona has 511 special sales tax jurisdictions with local sales taxes in. TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018. Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement.

Click here for a larger sales tax map or here for a sales tax table. The City of Tucson is asking voters to consider a half-cent sales tax increase over the next five years. Amusements Commercial rental leasing and licensing for use.

The current total local sales tax rate in South Tucson AZ is 11100. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower. Effective July 01 2009 the per room per night surcharge will be 2.

Retail Sales 017 to five percent 50 Communications 005 to five and one-half percent 55 and Utilities 004 to five and one-half percent 55. Groceries and prescription drugs are exempt from the Arizona sales tax. This change has an effective date of October 1 2019.

Click the sales tax you want to edit. Arizona Sales Tax Rates By City County 2022 State And Local Sales Taxes In 2012 Tax Foundation Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia. Tubac AZ Sales Tax Rate.

Please complete and return this form for any contracts or projects inside Tucson city limits that qualify for this grandfathering. The form is fillable if opened in Adobe Acrobat or Adobe Reader otherwise it may be printed and. Tucson AZ Sales Tax Rate.

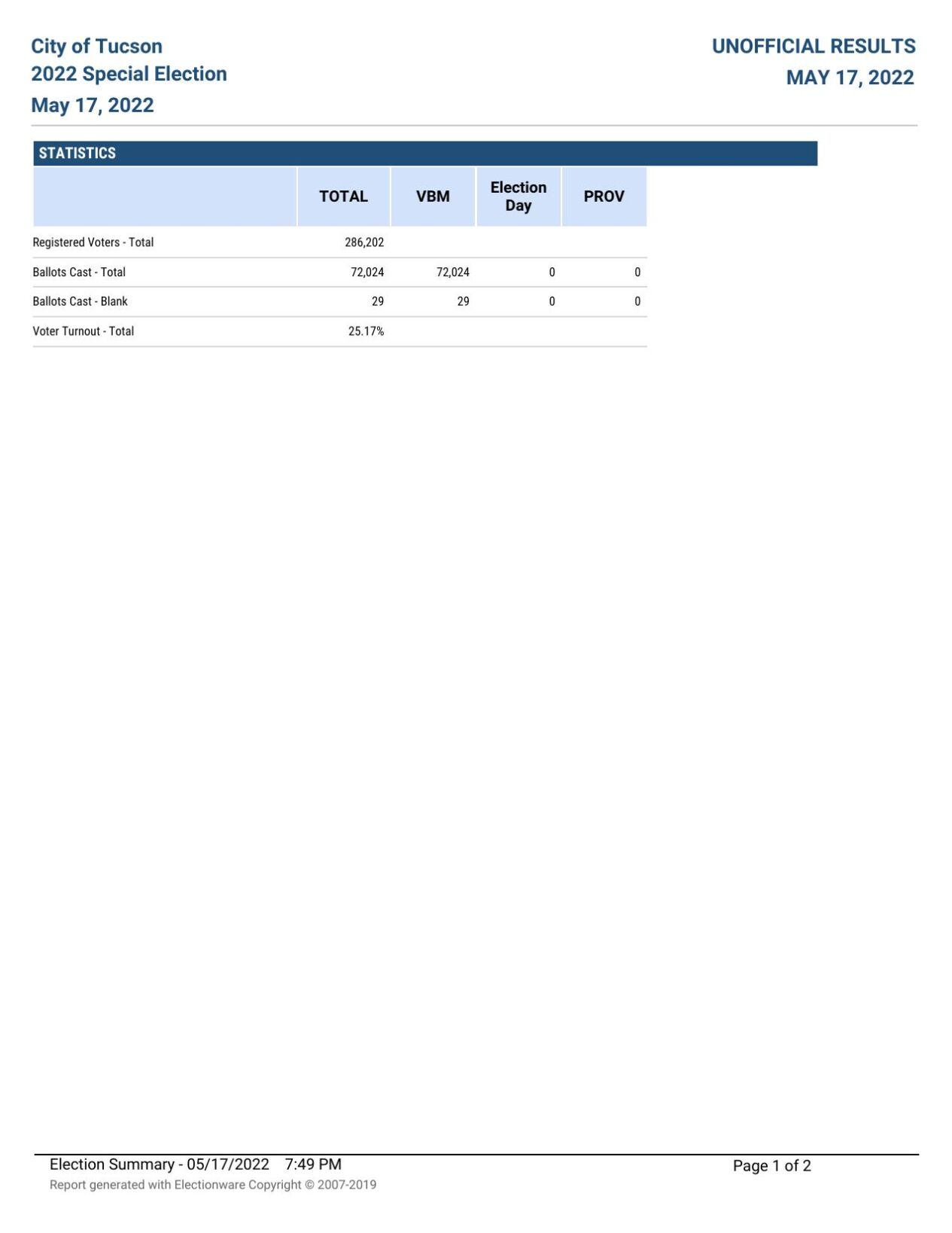

The following are the tax rate changes. Prop 101 was the only item on the ballot for the special election that ended Tuesday May 16 but voters have been sending in ballots for weeks. Combined with the state sales tax the highest sales tax rate in Arizona is 111 in the city of.

Effective July 01 2003 the tax rate increased to 600. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86.

State And Local Taxes In Arizona Lexology

Property Taxes May Move Into Suburbs Government Politics Tucson Com

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

Arizona Sales Tax Rates By City County 2022

Solved I Struggled With The Automatic Sales Tax Setup No

Property Taxes May Move Into Suburbs Government Politics Tucson Com

Property Taxes In Arizona Lexology

Arizona Senate Oks Changing Vehicle License Tax Formula Govt And Politics Tucson Com

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Monday Map Sales Tax Exemptions For Groceries Tax Foundation